Effective for returns that are required to be filed after December 31, 2019, the SECURE Act increased the penalty to 250 per day, not to exceed 150,000 for a late-filed form. Medicare will deny claims if they arrive after the deadline date with a few exceptions as explained on the next page.

TIMELY FILING CALCULATOR PROFESSIONAL

It is an estimate based on current Cost of Attendance (COA). Under the SECURE Act, penalties have increased substantially. Timely Filing Medicare Billing: Form CMS-1500 and the 837 Professional Timely Filing Providers must file Medicare claims to the appropriate MAC no later than 12 months, or 1 calendar year, after the date of service. This is not an official award notice and it is not binding on JMU or the Department of Education. SECONDARY FILING must be received at Cigna-HealthSpring within 120 days from the date on the Primary Carrier’s EOB. Please enter information about your employees federal tax filing and. What amount will you receive in scholarships for the academic year ? CLAIM TIMELY FILING POLICIES To ensure your claims are processed in a timely manner, please adhere to the following policies: INITIAL CLAIM must be received at Cigna-HealthSpring within 120 days from the date of service. Use Gustos salary paycheck calculator to determine withholdings and calculate. What is your FAFSA Expected Family Contribution (EFC) ? When did you file your Dept of Education FAFSA application ? If you are completing a paper FAFSA, make sure you allow time for your application to reach the Department of Education by the deadline. We suggest you submit the FAFSA on-line at a few days before March 1st to ensure timely receipt. James Madison University's FAFSA filing priority date for entering freshmen and returning students is March 1st, which means the Department of Education must receive your FAFSA by this date. Thus the combined penalty is 5 (4.5 late filing and 0.5 late payment per month. Appeals Calculator To determine the timely filing date for your appeals request: Step One Please select an option from the drop-down based upon which level of appeal you are in (see table at bottom of page). When a taxpayer is charged with a penalty for both types of failures i.e failure to file as well as failure to pay -the rate of failure to pay penalty is reduced by 0.5 for months when both penalties are imposed. Secondary claims must be submitted within 90 days. The penalty won’t exceed 25 of your unpaid taxes.

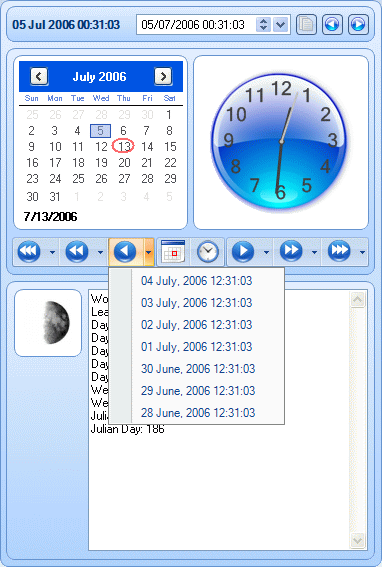

TIMELY FILING CALCULATOR HOW TO

This estimation is not intended to serve as a financial aid award notice. How to calculate the Timely Filing Deadline for submitting a claim to the patients Secondary Insurance. The figures provided in this tool are estimations and are subject to change based on changes in school costs, changes to your Free Application for Federal Student Aid ( FAFSA), modifications to awarding formulas, and fund availability. This online estimator was developed to help families plan for future educational costs at James Madison University.

0 kommentar(er)

0 kommentar(er)